Using information from the preceding comprehensive example, the effects of each cost flow assumption on net income and ending inventory are shown in Figure 6.14. Using the information above to apply specific identification, the resulting inventory record card appears in Figure 6.6. The following dataset will be used to demonstrate the application and analysis of the four methods of inventory accounting. All of the preceding issues are of less importance if the weighted average method is used. This approach tends to yield average profit levels and average levels of taxable income over time.

Review Questions

This gross profit of $22 lies between the $25 computed using the periodic FIFO and the $20 computed using the periodic LIFO. The cost of goods sold (which is reported on the income statement) is computed by taking the cost of the goods available for sale and subtracting the cost of the ending inventory. To illustrate this method, assume that the Cerf Company an assumption about cost flow is used is able to determine that the 600 items in the ending inventory are from the specific purchases listed below. The reason that we can merge these two layers is that under the FIFO method, these goods will be the first ones sold in the next year. Third, income tax laws enable the government to assist certain members of society who are viewed as deserving help.

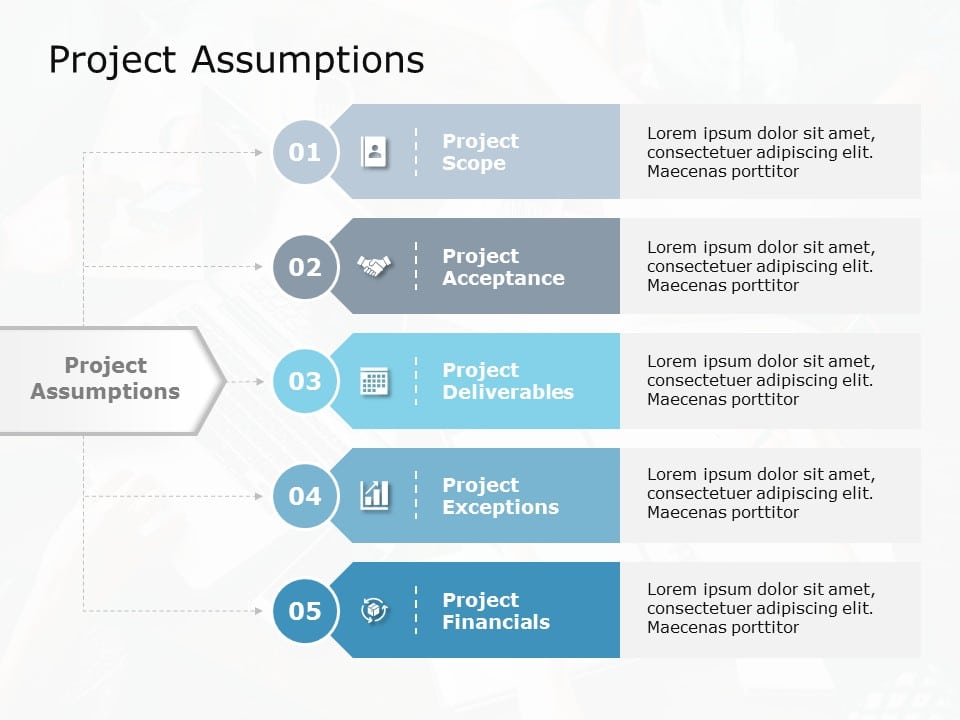

How do companies choose a cost flow assumption?

The cost flow method in use must be disclosed in the notes to the financial statements and be applied consistently from period to period. An error in ending inventory in one period impacts the balance sheet (inventory and equity) and the income statement (COGS and net income) for that accounting period and the next. However, inventory errors in one period reverse themselves in the next.

Average Cost Flow Assumption: Meaning, Example, Pros and Cons

- As before, we need to account for the cost of goods available for sale (5 books having a total cost of $440).

- Using the information above to apply specific identification, the resulting inventory record card appears in Figure 6.6.

- What informational benefit could be gained by knowing whether the first blue shirt was sold or the second?

The company’s financial statements report the combined cost of all items sold as an offset to the proceeds from those sales, producing the net number referred to as gross margin (or gross profit). This is presented in the first part of the results of operations for the period on the multi-step income statement. The unsold inventory at period end is an asset to the company and is therefore included in the company’s financial statements, on the balance sheet, as shown in Figure 10.2. In addition to questions related to type, volume, obsolescence, and lead time, there are many issues related to accounting for inventory and the flow of goods.

Application of Different Cost Flow Assumptions FAQs

Average cost flow assumption is a calculation companies use to assign costs to inventory goods, cost of goods sold (COGS), and ending inventory. An average is taken of all of the goods sold from inventory over the accounting period and that average cost is assigned to the goods. There were 5 books available for sale for the year 2023 and the cost of the goods available was $440.

These costs will vary depending on the inventory cost flow assumption used. As we will see in the next sections, the cost of sales may also vary depending on when sales occur. Determining the cost of each unit of inventory, and thus the total cost of ending inventory on the balance sheet, can be challenging. We know from Chapter 5 that the cost of inventory can be affected by discounts, returns, transportation costs, and shrinkage. Additionally, the purchase cost of an inventory item can be different from one purchase to the next. For example, the cost of coffee beans could be $5.00 a kilo in October and $7.00 a kilo in November.

The reported inventory balance as well as the expense on the income statement (and, hence, net income) are dependent on the cost flow assumption that is selected. Because different cost flow assumptions can affect the financial statements, GAAP requires that the assumption adopted by a company be disclosed in its financial statements (full disclosure principle). Additionally, GAAP requires that once a method is adopted, it be used every accounting period thereafter (consistency principle) unless there is a justifiable reason to change. A business that has a variety of inventory items may choose a different cost flow assumption for each item. For example, Walmart might use weighted average to account for its sporting goods items and specific identification for each of its various major appliances.

For example, taxpayers who encounter high medical costs or casualty losses are entitled to a tax break. Donations conveyed to an approved charity can also reduce a taxpayer’s tax bill. The rules and regulations were designed to provide assistance for specified needs. Second, income tax laws enable the government to help regulate the health of the economy. Simply by raising or lowering tax rates, the government can take money out of the economy (and slow public spending) or leave money in the economy (and increase public spending).